How to Start Moving Towards Your Dreams

Chasing your financial dreams sometimes feels like a marathon, when all that you yearn is a 100 meters dash to the finish line. You know you are not a spectator in the game of life; you are a participant from day one. And from day one, you have been struggling to make ends meet. Any winning break right now would be a perfect opportunity to pump your fist and say, “Yeah!”

For the most part, your marathon is not against other people; it is against your doubts, your fears, the state you are in and the stories you tell yourself. That may not be you, right? It’s just how you can save and invest when you are living from paycheck to paycheck and can’t find the extra hours to pick up a part-time hustle. Your expenses and debt are sprinting much faster than your income, and you just can’t seem to put away any savings, much less building wealth.

Feeling overwhelmed, you say to yourself, “one day, I will start saving and investing when the time is right or when my circumstance changes.” And deep down inside, you know this is not where you need to be financially and not what you dream to be doing with your life.

For years, I was running down this painful path of living from paycheck to paycheck before learning how to control my expenses, which is allowing me to increase my 401K contribution each year. I followed the strategies and principles of people who had gone down this path before, which it turned their lives around and they shared their stories and principles with the world. For example, I shopped and negotiated for better insurance deals on my home and cars, reduced my heating and other utility bills and changed my cable TV to streaming TV services. So, after three years of marriage, my wife and I were finally able to afford to go on our dream honeymoon cruise last December to the Caribbean. Imagine that! What is stopping you or standing in your way from living your dreams?

Listen, the work is behind the scenes. The competition is the easy part.”

– Usain Bolt

World record sprinter, Usain Bolt, said the real work for his success on the track is behind the scenes. Let that sink in for a minute and then ask yourself if you are doing the real work to be successful.

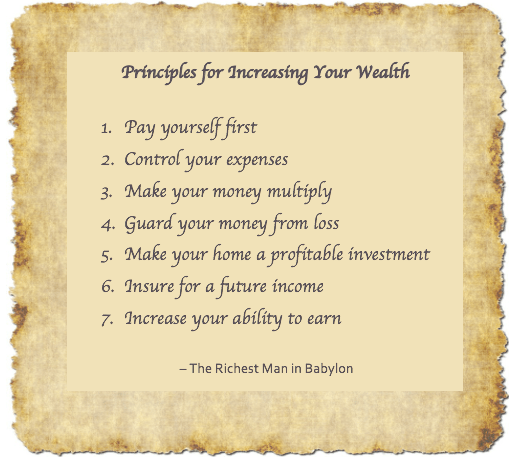

Below, you will find 7 basic financial principles that have been transforming my life over the years. I adopted these principles from the book “The Richest Man in Babylon.”

- Pay yourself first:

Start your saving with at least 10% of your income. If you can save more, that is even better. If you are not at the place right now, start with 3% and work your way up.

- Control your expenses:

This requires careful budgeting for surplus. Plan to live on 90% or less. There are many ways to reduce your expenses and I will share some links with you in the bonus section.

- Make your money multiply:

Your money should be making more money for you while you sleep. So, take full advantage of compounding your money in safe, steady investments such as 401K and Roth IRA.

- Guard your investments from loss:

There are many get-rich-schemes out there; some offer big returns in a short period of time. It is extremely important that you only invest in areas where you have experience or do business with people who are highly experienced in these areas.

- Make of your home a profitable investment:

There are many ways to look at this. Some experts believe you should purchase the house you live in so you are not wasting your money on rent. You can also rent a section of your house, and if you have a large enough land, you can grow fresh vegetables for market.

- Insure for a future income:

No one knows what the future holds. Having safe, realistic insurance, asset allocation and diversification programs safeguard your investments for the future.

- Increase your ability to earn:

In today’s world, you find yourself constantly learning to use new technology. With this comes opportunities to increase your abilities to earn. Set aside time each week to learn a high income skill to increase your earning. In the bonus section, I will share with you an inexpensive way to acquire these skills.

If a strategy does not work for your situation, don’t throw up your hands and say you have tried everything. Try another strategy and keep grinding. Now with massive action, the success principles in this video will get you unstuck and moving towards your dreams.

AN ULTRA MINI-SERIES ADVENTURE

BY RAY DALIO

The Real Work is Behind the Scenes

- Learn A High-Income Skill or Improve Your Current Skills

These online lessons are not expensive and the best part about it is you can go at your own pace. Be sure to check out any reviews on the instructors before you make your selections.

- Earn Some Extra Income:

Teaching English online is an impactful way to earn some extra cash from the comfort of your home.

Fiverr is a great way to use your current abilities and skills to earn some extra cash. The trick is to land your clients and have them leaving good reviews. So, you have to be creative marketing yourself and providing excellent work for your clients.

Become a host with Airbnb and earn some extra cash for a house or a room that is unoccupied. For more info on how this works, click on the link above.

If you don’t have a room or house to offer through Airbnb, don’t worry, you can also earn cash by offering people an exciting experience or adventure. For more info on how this works, click on the link above.

- Start Saving and Investing Online:

- Lending Clubs. Time to start being the money lender for the change

- Monitor and Manage Your Credit Cards and Credit Score for Free.

- For Assistance Paying off Your Credit Cards:

Check out Financial Peace University with Dave Ramsey

*Also, check out Robert Kiyosaki Rich Dad Education and his approach to paying off debt.